To be a successful trader the number one focus of your strategy should be position sizing and risk management. It is not the only factor that will make you profitable, other variables come into play including the actual strategy itself. However it is the one thing that will keep your account alive, therefore with every single trade you place you should always know what you stand to lose before you enter into that trade.

In this post I will cover everything you need to know about managing the risk of a trade and how to calculate the correct position size relative to the size of your trading account, if you apply the information you learn here into your trading and investing you will minimize the loses on your account and if a trade doesn’t go as expected you will survive to fight another day.

Risk Management

The goal of risk management is to minimize losses with having to sacrifice upside potential. A popular rule is not risking more that 1% of your total account value on any one trade, by applying this rule with a risk/reward ratio for example of 3 to 1 this gives a maximum downside risk of 1% with a potential upside reward of 3% of the total account value.

Lets look at some examples of this in practice. Lets assume we are trading with an account that has a balance of $10,000. If we stick to the rule above where our risk is 1% that means if the trade goes against us we stand to lose $100 but if the trade goes in our favour and we reach our upside target of of 3 to 1 risk/reward ratio we stand to profit by $300. In general this is a good starting point, the reward is far greater than risk.

Position Sizing

Now that we have determined a risk/reward ratio that we would like to set for a trade we need to calculate the position sizing for that trade. This will be determined by where we place our stop loss. The closer the stop loss is to the entry price the less upside price action we need to reach the 3 to 1 ration target, the further away the stop loss is more price action upside is required to reach the target.

Trade Example

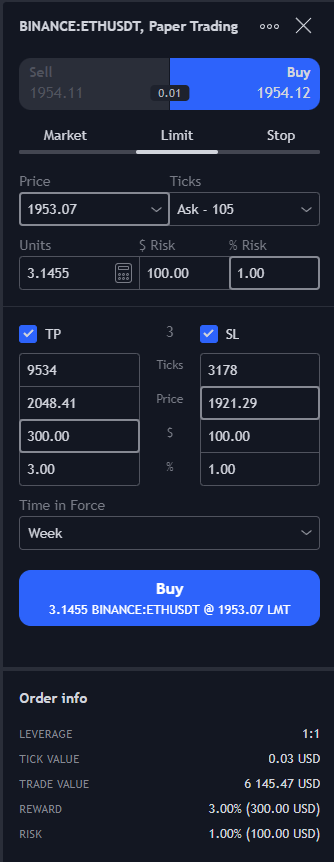

In the example trade below on Ethereum we have determined that our entry price will be $1953.07, we have a stop loss positioned at $1921.29 and our upside target is $2048.41. When we feed that data into the trading panel on Tradingview it will tell us the position size needed for this trade. In this case it is 3.1455 ETH we need to buy which is a position size of $6145.47.

If the stop loss is placed closer to the entry price then the position size will change. The risk of 1% or in this case $100 remains the same but the amount of units we need to buy will change. With a stop loss placed at $1936 the position size would be 5.8562 ETH and the take profit would also be reduced to $2004.28. We need less upside price action to reach our take profit target but we have less room on the downside before the stop loss is reached and the trade is exited. However in both cases the risk and reward remains the same.

In the second case the actual dollar value of the trade would be $11,441.46 which is higher than the amount of money available to trade in our account. This where leverage comes into play, we would essentially need to borrow money from the exchange to execute the trade.

Before the trade is executed we are setting our risk by selecting where we will place our stop loss, correspondingliy where we expect the price to reach for our profit taking and using these prices to determine the position size for the trade. This is done based on whatever trading strategy you are using to determine those levels.

The Risk Reward Ratio

Now that we know how risk management and position sizing works how do we determine which risk reward ratio to chose.

This can easily be decided by back testing a trading strategy to determine the win rate percentage of the strategy.

The chart below shows what risk/reward ratio is needed to just break even. You can use this to determine which ratio will work best for your strategy.

| Risk | Reward | Breakeven Win Rate % |

| 5 | 1 | 83% |

| 4 | 1 | 80% |

| 3 | 1 | 75% |

| 2 | 1 | 67% |

| 1 | 1 | 50% |

| 1 | 2 | 33% |

| 1 | 3 | 25% |

| 1 | 4 | 20% |

| 1 | 5 | 17% |

We can see above that with a risk/reward ratio of 3 to 1 we only need to be right 25% of the time to break even. The more risk we add the higher the win rate required just to break even. Personally a ratio between 2 and 3 to 1 is what I aim for in my trades. There is no perfect number to choose since every trading strategy will yield different results. Find the win rate of your strategy through back testing and work from there.

Conclusion

Risk management and position sizing is essential before entering any trade. You must know what you are comfortable losing and what you stand to gain from any trade. Blindly entering a trade, especially when using leverage is a disaster waiting to happen and a sure way to blow up your trading account. Combined with a good trading strategy you would need to be wrong many times in a row to destroy your account.

Risk Management and Position Sizing